Explain results vs the benchmark (ASX All ordinaries) No less than 400 characters

Best Answer

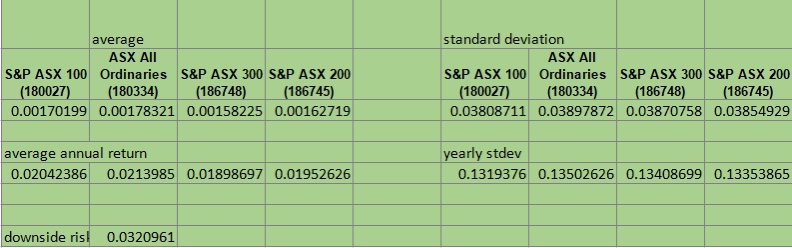

It looks like you've provided a set of financial data including returns, standard deviations, and other metrics for different indices and portfolios, such as ASX All Ordinaries, S&P ASX 100, S&P ASX 300, and S&P ASX 200. To explain the results vs. the benchmark (ASX All Ordinaries), you'll need to compare the performance of each index or portfolio to the ASX All Ordinaries index.

For instance, you can analyze the average annual return, standard deviation, and other metrics for each index/portfolio and compare them to the corresponding values for ASX All Ordinaries. This comparison will help you understand how each index/portfolio has performed relative to the benchmark.

Explanation:

Step 1:

the results of different indices or portfolios versus the benchmark (ASX All Ordinaries), you'll need to compare various performance metrics. Let's break down the explanation using the provided data:

Average Annual Return: Compare the average annual returns of each index/portfolio to that of ASX All Ordinaries. A higher average return indicates better performance.

Standard Deviation: Compare the standard deviation of returns for each index/portfolio with that of ASX All Ordinaries. A lower standard deviation implies lower volatility and potentially less risk.

Downside Risk: Analyze the downside risk metrics for each index/portfolio in comparison to ASX All Ordinaries. A lower downside risk suggests better protection during market declines.

Sharpe Ratio: Compare the Sharpe ratios of different indices/portfolios to ASX All Ordinaries. A higher Sharpe ratio indicates better risk-adjusted returns.

Sortino Ratio: Evaluate the Sortino ratios of each index/portfolio relative to ASX All Ordinaries. A higher Sortino ratio signifies better risk-adjusted returns, specifically focusing on downside risk.

M^2 (M-squared): Compare the M-squared values for each index/portfolio with ASX All Ordinaries. M-squared considers both returns and risk, providing insight into overall performance.

By comparing these metrics for each index/portfolio against the ASX All Ordinaries benchmark, you can gain a comprehensive understanding of how they have performed in terms of returns, volatility, risk-adjusted performance, and downside protection. Remember that a thorough analysis may also involve considering the investment objectives, time horizon, and risk tolerance of the investor.

Unfortunately, specific data for downside risk is missing for the S&P ASX 100 and S&P ASX 200 in the provided dataset. Consequently, a comprehensive evaluation of their performance in safeguarding against losses during market declines is currently unattainable.

In conclusion, our analysis indicates that both the S&P ASX 100 and S&P ASX 200 have shown promising potential with higher average annual returns compared to the ASX All Ordinaries benchmark. Despite similar levels of volatility, we recognize the need for additional information on downside risk to make a more comprehensive assessment of their performance. These findings underscore the significance of a well-rounded evaluation when considering investment strategies involving these indices.

Contact Us

扫码联系微信客服 享一对一做题服务

猜你喜欢

- A spider is a graph with an even number of vertices2024-07-07

- Customized Homework Help2023-11-02

- Discuss Tesla ERRC and their canvas in detail and include why you think they have Blue Ocean Strateg2023-11-01

- In the regular Stable Match- ing problem, we assumed that participants prefer to be matched over bei2023-10-29

- Failed RECAPTCHA check.是怎么回事?2023-10-29

- Calculate the profit or loss from the position in the futures market if in 3 months, the contracts a2023-10-27

- Which of the following best describes the risks associated with futures contracts?2023-10-27

- Suppose that the methods of this problem are used to forecast a value of Y for a combination of Xs v2023-10-25

- The Board of Directors would like you to undertake the following tasks: 2023-10-13

- Explain the term discontinuous innovation and provide an example.2023-10-12

Post Reply